Morgan Stanley vs Charles Schwab Review: Both Morgan Stanley and Charles Schwab are large American brokerage firms whose business model works completely differently in the financial world.

Charles Robert Schwab, the founder of the discount brokerage company “Charles Schwab Company”, is a famous American investor and businessman. He is one of the richest investors in the world.

Further in this article, all the information related to Morgan Stanley vs Charles Schwab has been explained in very simple and easy language. Apart from this, we have also mentioned the biography of Charles Schwab. We hope that after reading this our readers will get good information.

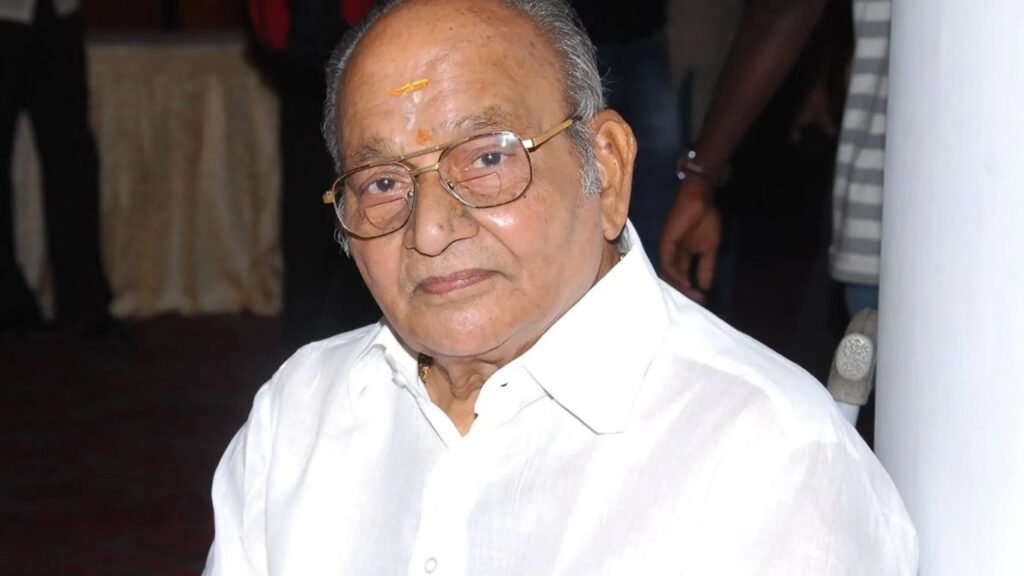

Charles Schwab Bio

| Full name | Charles Robert Schwab |

| Profession: | Businessman, Investor |

| Best Known for: | Owner & CEO of Charles Schwab Corporation |

| Born: | July 29, 1937, Sacramento, California, U.S. Alma mater |

| Age: | 86 Years |

| Weight: | 76 kg ( 167 Pound) |

| Height: | 1.67 m ( 167 Cm ) |

| Education: | Stanford University (BA, MBA) |

| Spouse: | Susan Cotter (div. the 1970s) Helen O’Neill |

| Children: | 5 (Charles Jr., Carrie, Virginia, Michael, and Helen) |

| Nationality: | American |

Who is Charles Schwab?

Charles Robert Schwab is a veteran American businessman and stock investor who was born on July 29, 1937 in Sacramento, California to Terry Schwab and Lloyd Schwab.

He is the owner of the “Charles Schwab & Company”, which he founded in 1971. It is one of America’s largest stock brokerage companies whose headquarters is located in Westlake, Texas.

Early Life and Education background

Schwab was raised in Sacramento, California. She studied at Santa Barbara High School in California and Holy Rosary Academy in Woodland, California.

He earned a bachelor’s degree in economics from Stanford University in 1959 and a master’s degree in business administration from the Stanford Graduate School of Business in 1961.

Charles Schwab Debut Career

Charles Schwab started his own start-up in 1963 called “Newsletter Investment Indica”. He founded this investment newsletter with the cooperation and partnership of three people. In 1971, Schwab along with his partners changed the name of the company to First Commander Corporation. In the initial phase, one had to pay 84 dollars per year for the membership of this company, gradually 3000 customers joined this company.

Schwab purchased all of First Commander Industries’ stock in 1972 and changed its name to “Charles Schwab Company”.

Charles Schwab Corporation

Charles Schwab knew that the companies established there in the 1970s paid little attention to the needs of their customers in order to earn high commissions and profits, and consumers had to suffer the consequence.

Understanding these market conditions, he founded Charles Schwab & Company in 1973 and halved company fees for his clients, and issued a toll-free number for clients to place orders anytime, anywhere.

In 1975, after the Securities and Exchange Commission deregulated the securities industry through Securities Act amendments, he founded the first branch of Charles Schwab & Company in his hometown of Sacramento.

In 1977, two years after the company was founded, Schwab began offering seminars to clients, which turned a profit, and by 1978 the company had a total of 45,000 client accounts, and in 1979 the number increased to 84,000.

When Schwab established his company’s first 24-hour quotation service in 1980, the total number of client accounts reached 147,000.

When Schwab became a member of the NYSE in 1981, the total number of client accounts at his company had reached 222,000.

After becoming a member of the NYSE in 1981, Bank of America offered Schwab $53 million in stock for 37 percent ownership. However, Bank of America’s stock declined, leading to an investigation against Schwab for insider trading were selling stocks to take advantage of the information. But Schwab denied this and was acquitted of the charges.

In 1982, Charles Schwab & Company became the first firm in the US to provide 24/7 order entry and quotation service.

After this the company opened its first international office in Hong Kong. At that time the number of customers of this company was 374,000.

Charles Schwab & Company reached 1.6 million customers in 1986 with sales of $308 million.

1990s Revolution of World Wide Web

The rise of the World Wide Web in the 1990s presented a new challenge for Charles Schwab & Company, but in 1996 Schwab met this challenge by becoming the first major financial services firm to sell listed, over-the-counter stocks, and mutual funds.

Schwab always emphasised cutting-edge technology and introduced computerization to replace paperwork. By 1995, Charles Schwab & Company was the largest discount broker in the US with $1.4 billion in revenues and $200 billion in assets under management. By 1996, the company had 3.6 million active customer accounts.

From 1998 to 2005, Mobile/Wireless Trading

In 2000, Charles Schwab & Company introduced mobile/wireless trading in the US markets through its PocketBroker mobile app, which worked on RIM (BlackBerry), Palm, Windows CE and WAP-enabled phones.

After Charles Schwab stepped down as CEO of the company in 2003, his colleague David S. Potruk was made CEO of the company, but just a year later the company’s board fired Porc and rehired Schwab.

The news that net profit fell 10 percent to $113 million in the second quarter due to a 26 percent decline in revenue from client stock trading led Potrock to exit.

The company rebounded after Charles Schwab came on board, and in 2005, earnings began to move in line with the stock.

The current CEO of Charles Schwab Corporation is Walter Bettinger II. It is one of the largest financial services companies in the United States. As of December 31, 2022, it had more than $7.05 trillion in client assets, 33.8 million active brokerage accounts and 2.4 million corporate retirement plan participants.

How did Charles Schwab revolutionise the brokerage industry?

When Charles Schwab & Company was launched, it was a revolution in the world of investing. They worked on a discount brokerage model and charged their clients much lower fees than traditional firms.

This company provided 24/7 mutual fund trading for its investors in 1986 through which investors are allowed to buy and sell funds at any time, not just during market hours.

The company launched online trading in 1986 which made trading even more convenient and efficient. After this the company released everything from mobile apps to AI-powered investment tools.

Due to all these factors the company established its existence throughout America. It changed the entire brokerage industry, making investing more accessible, affordable and transparent for everyone.

Morgan Stanley vs Charles Schwab Review

Both Morgan Stanley and Charles Schwab are large American brokerage firms whose business model works completely differently in the financial world.

Charles Schwab

Charles Schwab & Company is a discount brokerage company that provides commission-free investment information to its clients. It also provides some investment management and wealth management services.

These are online trading companies that offer a wide range of investment options including stocks, bonds, funds of funds, and ETFs.

Charles Schwab Corp stock has a Momentum Score of 23, an Estimate Revision Score of 44, and a Quality Score of 73.

Morgan Stanley

The service of Morgan Stanley Company is purely brokerage in which fees have to be paid. It focuses on high-net-worth individuals (HNIs) and rivals. It provides comprehensive services including investment management and wealth management.

This company offers a wide range of stocks, bonds, funds of funds, and other investments to investors. It has a Momentum Score of 66, Estimated Revision Score of 51 and Quality Score of 34.

So based on these scores and metrics, the grades of Charles Schwab Corp and Morgan Stanley can be compared to determine whether they could be a good investment or not.

Or you can use AAII to find out your portfolio’s asset allocation to see if your stocks are risky or not. You can rely on AAII for financial planning and stock-selection, unbiased research, and actionable analysis.

Morgan Stanley vs Charles SchwabIf you want more information for that comparison, please read https://www.comparably.com/competitors/charles-schwab-and-company-inc-vs-morgan-stanley.

What books has Charles Schwab written?

Charles Schwab is counted among the great investors of the financial world. He has made a name for himself all over the world through his work. He has also written several books on investing and personal finance, the list of which is given below.

- Invested: Forever Changing the Way Americans Invest (2023): This book details Schwab’s life and career as well as his views on the future of investing.

- Charles Schwab’s Guide to Financial Freedom: Simple Solutions for Busy People (1997): This classic guide offers practical advice for achieving financial freedom.

- Charles Schwab’s New Guide to Financial Freedom: Completely Revised and Updated (2010): This updated edition of Schwab’s guide reflects changes in the financial landscape since its original publication.

- Success with What You Have (1990): This book encourages readers to make the most of their resources, regardless of their income level.

- You’re Fifty–Now What?: Investing for the Second Half of Your Life (1995): This book provides guidance on investing for retirement and other financial goals in later years.

- It’s Worth Talking About: How to Have the Necessary Conversations with Your Family About Money and Investing (2018): This book helps families have open and honest conversations about money.

Charles Schwab Achievements

- Golden Plate Award (1989) by American Academy of Achievement

- King of Online Brokers (1997) by Forbes Magazine

- Financial Innovation Award (2016) by The Museum of American Finance

Charles Schwab Net worth

According to Forbes, Currently, Charles Schwab’s net worth is estimated at $10.2 billion. He is America’s biggest investor.

Charles is also known for his charitable duties. He donated $101,700 to the Republican National Committee’s legal defence fund in 2017. This amount was partially paid for the legal defence of President Donald Trump.

Charles Schwab Personal Life

Charles Schwab married twice in his life. His first marriage was to Susan Cotter Schwab, with whom he had three children, Charles Jr., Carrie and Virginia. But due to some family issues he divorced Susan.

Carrie is president of the Charles & Helen Schwab Foundation. She has also served as a council member on President Obama’s Council of Advisory services.

Charles Schwab second marriage was to Helen (O’Neill), with whom he had two children, Michael and Helen.

Conclusion

Overall, Charles Schwab is a veteran American businessman and stock investor who revolutionized the financial world through his C & Company. Today this company is one of the largest brokerage companies in America. Charles is an inspiration for the youth. Whatever he has achieved, he has achieved it on the basis of his intelligence and self-confidence.

Note: If any information related to Charles Schwab’s biography has remained incomplete, tell us by commenting.Thanks for reading this blog.